University of Melbourne quietly retires 76,000 ACCUs

What high-quality ACCU procurement looks like

The University of Melbourne’s approach offers insight into how institutions assess integrity and credibility.

Now that’s a total of 103,750 ACCUs used as offset cancellations this year towards their goal of Climate Active carbon neutrality by 2025. While there’s been no press release, Melbourne Climate Futures has published a Carbon Offset Procurement Framework talking about how the university selects credits.

Most organisations don’t have the inhouse resources for this level of due diligence. Independent rating tools provide a scalable, trusted way to benchmark offsets, without having to build frameworks from scratch.

This could pave the way for other universities and corporates, showing how much effort is needed to identify high quality credits for procurement.

How the framework works

Here’s what Melbourne University’s approach looks like in practice (pages 16 & 18):

✔️ Offsets must come from Climate Active approved standards (ACCUs, Verra) and must be making progress towards targets

✔️ Portfolio selection balances highest quality with volume, availability and budget

✔️ Screening criteria includes project type, geography, co‑benefits, age and permanence - to balance risk

The framework shows the university is serious about transparency and quality. It’s the kind of approach that some

organisations may not have the resources to replicate internally.

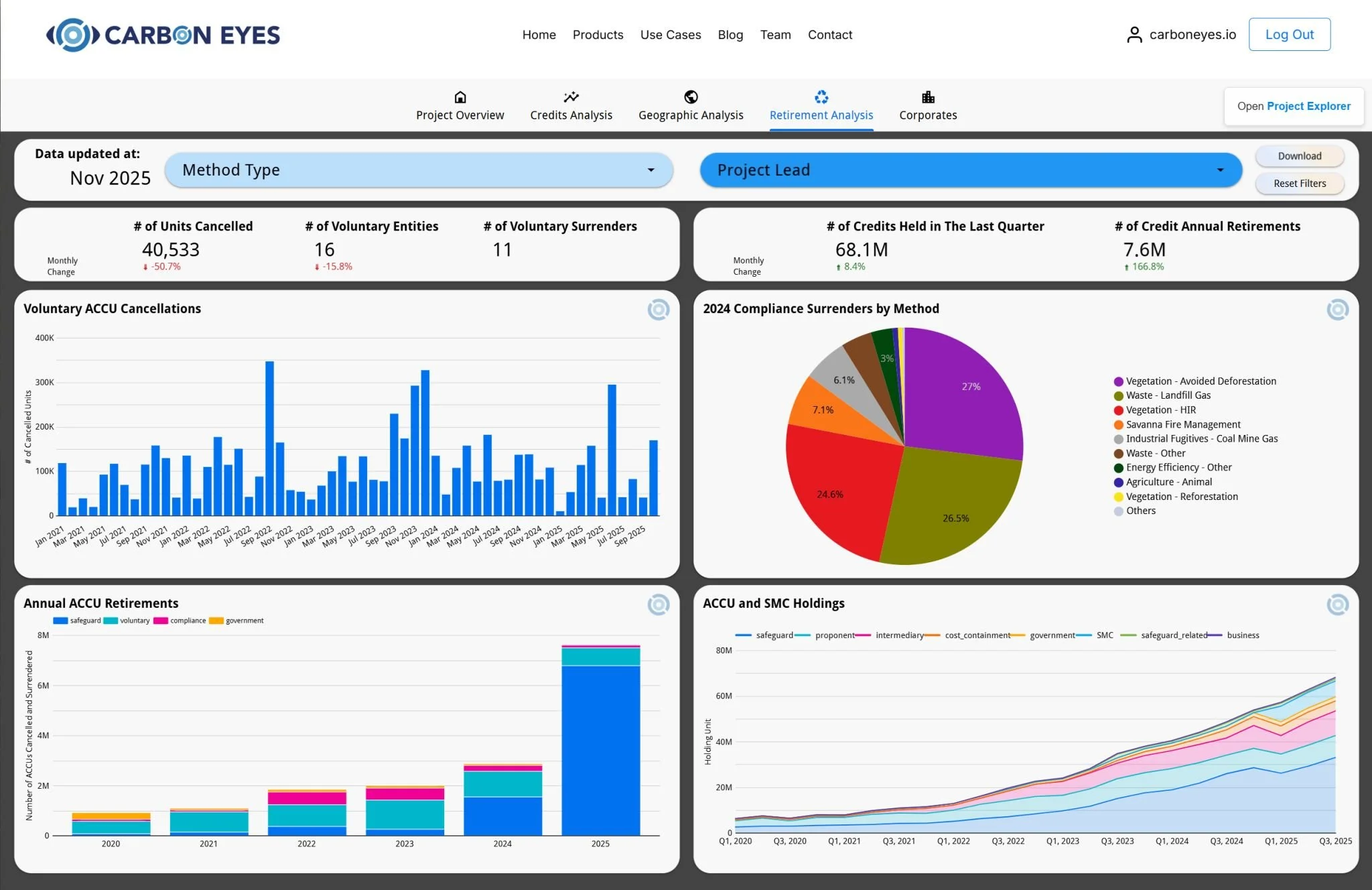

You can see this info under the Retirements and Corporates views on the Analytics Dashboard

Which projects supplied the credits?

Short answer - we don’t know.

The CER (Clean Energy Regulator) publishes the voluntary cancellations register. It shows the number of units and the date they were cancelled, but it does not publicly report whether the cancelling account is the ultimate buyer or a broker/aggregator acting on behalf of the buyer.

Even a large block like 76000 ACCUs cannot be traced to the specific projects that supplied the units retired by the university.

Check out our blog article Rio Tinto and the rise of high integrity carbon credits in Australia discussing how major emitters like Rio Tinto are increasingly turning to high quality ACCUs.

Why this matters

Large voluntary buyers need supply they can trust. They look for projects with clear co‑benefits, permanence and reliable issuance. That’s exactly the type of supply investors care about when looking at land, forestry, or agriculture projects with carbon potential.

When a major institution retires over 100,000 units in a year, it gives a sense of where demand is heading. Buyers are getting more selective and more transparent. They want project-level clarity and quality.

Setting an procurement standard for high integrity credits

The University of Melbourne example shows what thoughtful offset procurement can look like: clear rules, defined screening, independent benchmarking, significant volumes cancelled, and all without a big media announcement.

The University of Melbourne example shows what thoughtful offset procurement looks like in practice. Credits are sourced from Climate Active approved standards, selection is balanced across quality, availability and budget, and projects are screened by type, geography, co-benefits, age and permanence to manage risk. Independent benchmarking supports the process, and the university has already cancelled a substantial volume without making a big public announcement about it.

For the market, it shows that high quality supply is valued and will be increasingly sought out by corporate buyers. A quiet retirement of 76,000 ACCUs shows the direction of demand and the level of scrutiny larger organisations are starting to apply.

References

Clean Energy Regulator (CER):

University of Melbourne - Melbourne Climate Futures Oct 2024:

Developing a Carbon Offset Framework detailing the University of Melbourne’s Carbon Offset Procurement Framework

Want to know more?

Check out Indigenous land and corporate offsets: What is Qantas buying into?, talking about Qantas’ partnership with ALFA as an example of how carbon markets can support both climate and the community.

Carbon Eyes | ACCU Market Intelligence

Strategic data and integrity signals for the Australian carbon market.

1. Carbon Data Platform

The Foundation of Market Transparency | Access the Platform

A comprehensive view of the ACCU landscape. Access structured CER data, project status and issuance trends. Use our core mapping and analytics to establish your market baseline.

2. Integrity & Market Intelligence

Independent Ratings & Supply Forecasts | Upgrade Your Intelligence

Mitigate risk with our paid intelligence layer. Accessed directly within the Platform, these add-ons provide independent ACCU project ratings and forward looking supply forecasts to guide procurement and investment.

3. Land & Asset Decisioning

Identify the Best Opportunities for Carbon Projects

Carbon Potential Report | View Carbon Potential Report (by address)

Instant, address-based viability assessments for lenders and investors.

Carbon Land Search | Identify & Assess High-Potential Assets

Our premium search engine for institutional funds. Identify and de-risk high-potential carbon assets before acquisition.