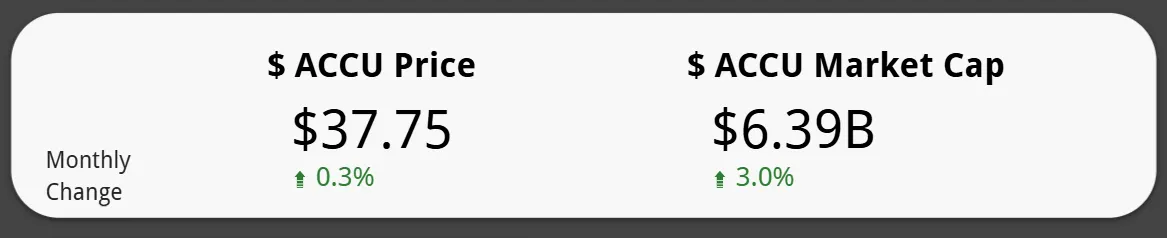

Rio Tinto and the rise of high integrity carbon credits in Australia

Why big emitters are changing credit preferences

Demand from companies like Rio Tinto is reshaping which ACCU methods are seen as high integrity. How environmental plantings and soil carbon are shaping the Australian ACCU market

Australia’s carbon market is evolving fast. Major emitters like Rio Tinto are increasingly turning to high quality Australian carbon credits, highlighting the crucial role of sustainable agriculture and environmental plantings.

According to the Australian Financial Review and Bloomberg (September 2025), Rio Tinto has signed up to acquire carbon credits from the newly established Meldora platform, a 250 million dollar farmland initiative backed by CEFC and La Caisse.

How Rio Tinto is tapping high-integrity Australian carbon credits

Environmental planting (EP) and sustainable agriculture projects are becoming key tools for major emitters like Rio Tinto to meet emissions targets. These projects, which often involve native species such as eucalypts and acacias, are valued for their reliability and long-term carbon sequestration, with some plantings maintained for 25 to 100 years.

For companies whose operational facilities fall short under the federal Safeguard Mechanism, sourcing high-integrity ACCUs through these methods provides a credible and durable way to offset emissions.

One notable example is the Meldora platform, which combines traditional agriculture with large scale environmental plantings. It’s a 15,000 hectare broadacre and irrigation farm in central Queensland, which generates Australian Carbon Credit Units (ACCUs) through sustainable farming and native species plantings.

Why major corporates are paying attention

Two Rio Tinto projects in Queensland - Weipa bauxite mine and Gladstone refinery - fell below Safeguard Mechanism requirements, illustrating why the company needs high quality carbon credits. Beyond environmental planting (EP), Rio Tinto also engages with methodologies like savanna fire management (SFM) and human-induced regeneration (HIR), showing a multi-faceted approach to carbon offsetting.

For investors like La Caisse, this is its first global move into carbon credits. Emmanual Jaclot is the company’s Executive Vice-President and Head of Infrastructure and Sustainability. Quoted by the Australian Financial Review, he says that ACCUs represent a reliable, accountable and high standards market, demonstrating how location and methodology can affect credit quality:

“We believe that the only simple way to sequester carbon is through tree. Right now, there’s no framework to value this offsetting except what we’re trying to test here with the ACCU market in Australia which is very advanced, very robust and massively auditable and reliable.”

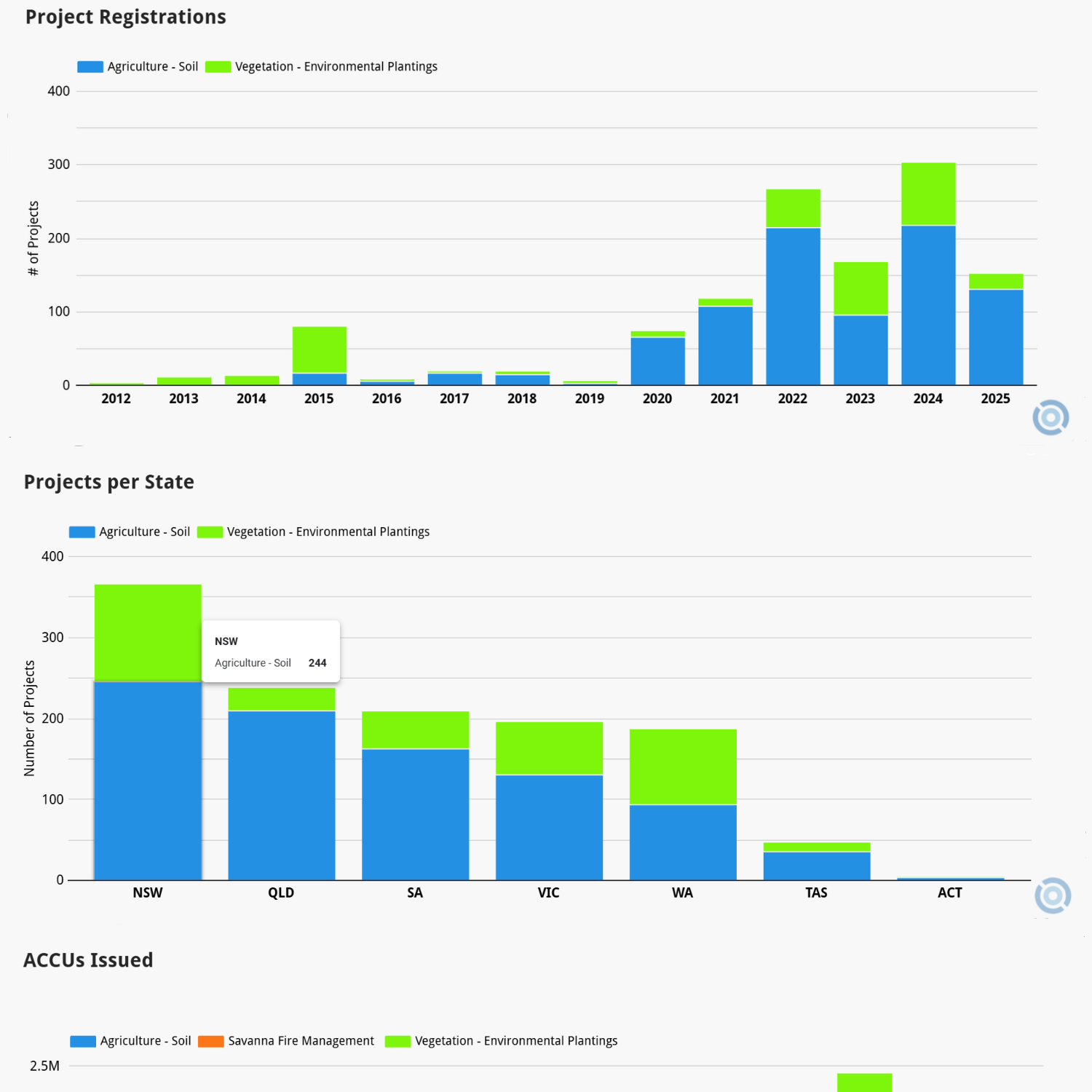

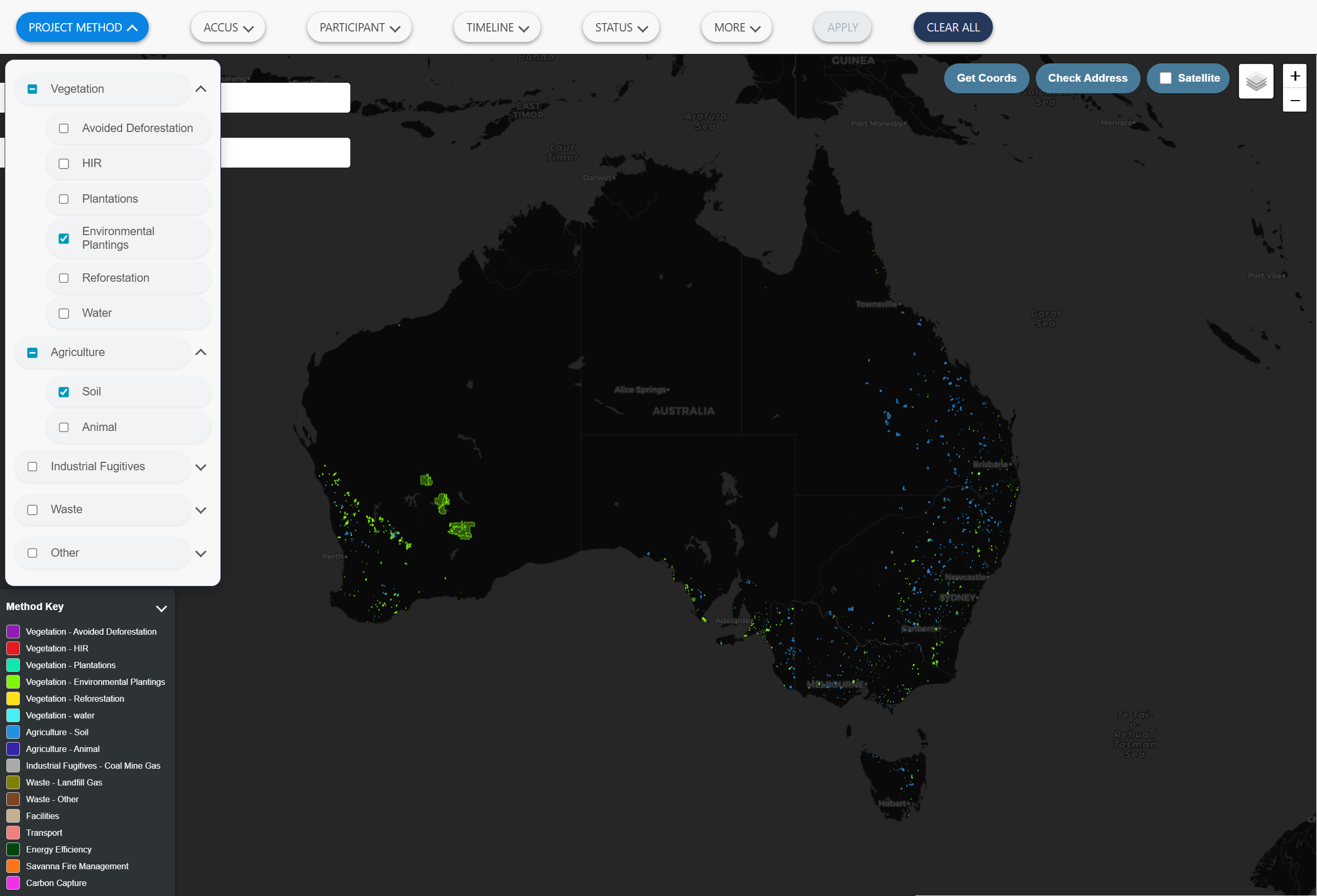

Satellite view of carbon projects across Australia

Geographic context matters

Regional context is critical in ACCU projects. Climate, soil, and land use all influence both agricultural yield and carbon sequestration potential.

With our Project Explorer, these patterns become visible on a map. It shows where soil carbon and environmental planting projects are registered across Australia and lets users search by region, project type, or proponent. This makes it easier to see how local conditions shape opportunities and where future investment is likely to flow.

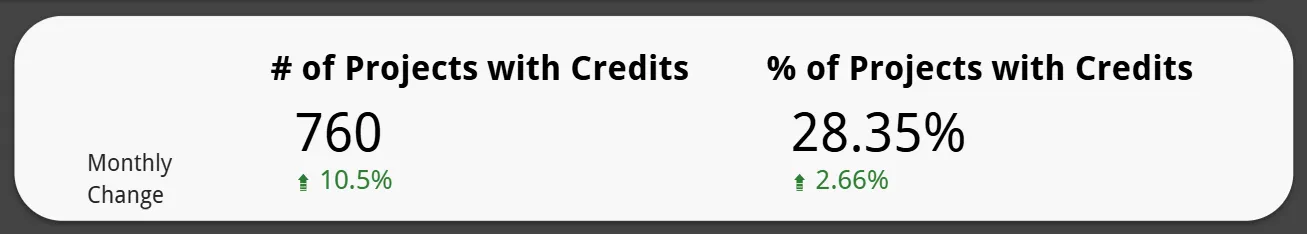

Applying this filter will show 1,309 projects across Australia

Filter applied shows the 1,309 registered Environmental Planting and Soil Carbon Projects

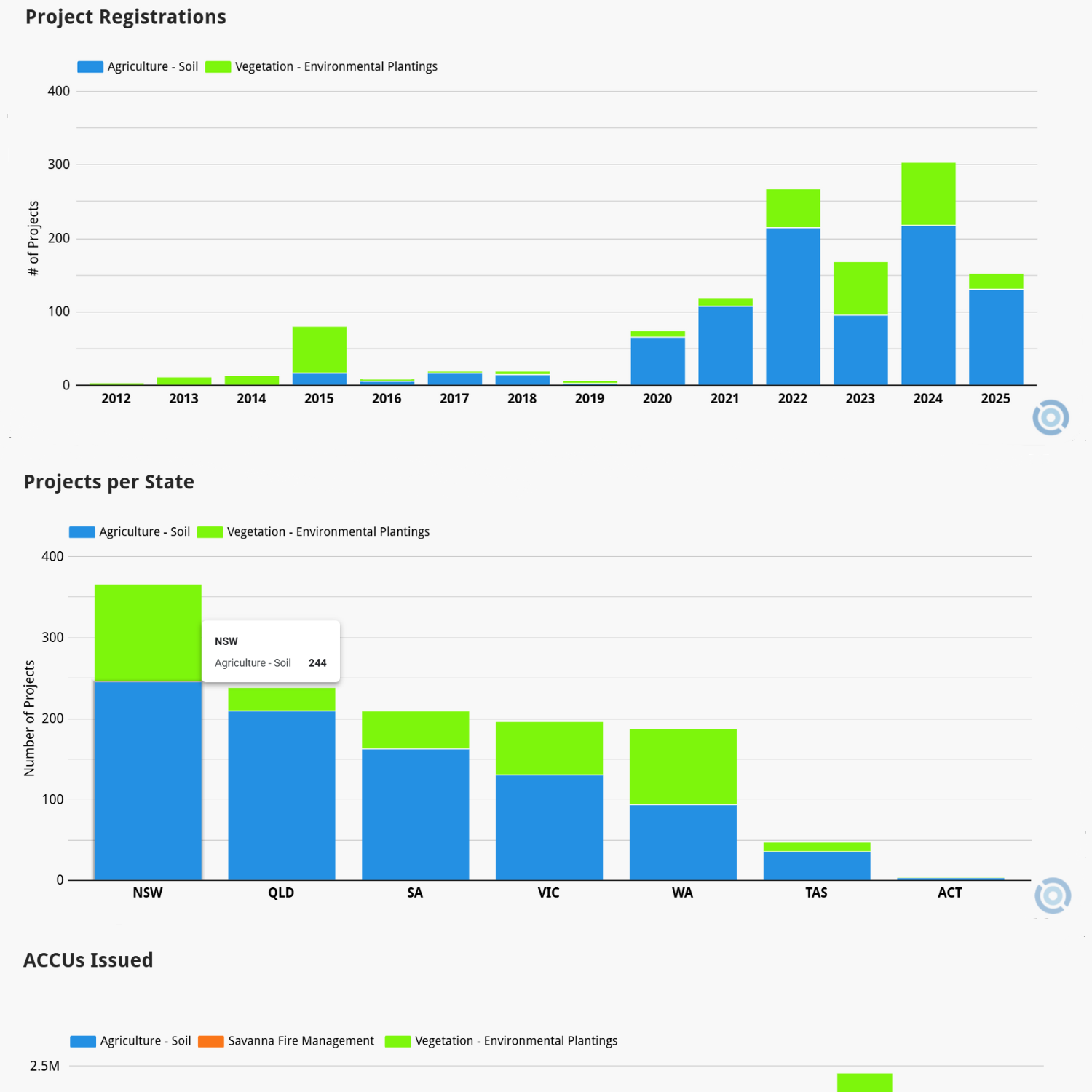

Project registrations for Environmental Planting and Soil Carbon Projects on the rise

Geography is only part of the picture, though. To understand the dynamics of supply and demand, it’s also important to look at the methodologies behind these projects and how they translate into real credit issuance.

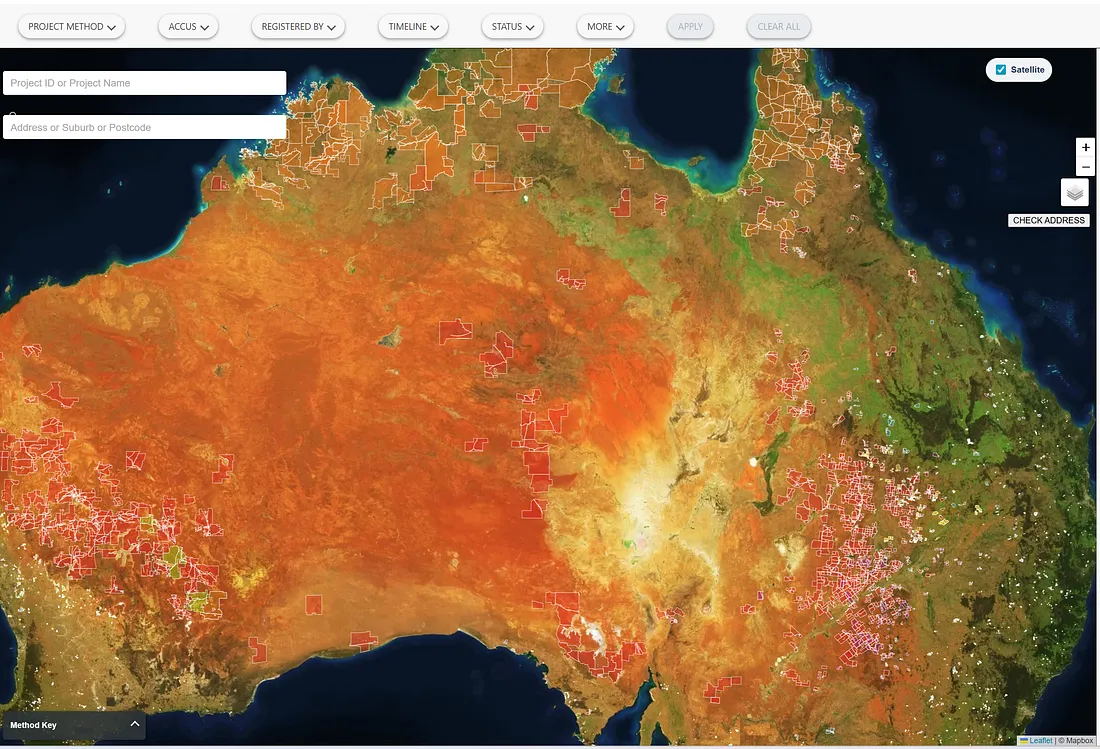

Linking methodology to market Insights

Understanding which methodologies generate the most reliable ACCUs is important for both investors and industry watchers. The Rio Tinto story signals a growing in interest in higher integrity carbon credits and co-benefits of certain methods.

Looking at the map of registered projects tells only part of the story. While there is strong interest in soil carbon and environmental planting projects across Australia, the number of ACCUs actually issued under these methods remains relatively low.

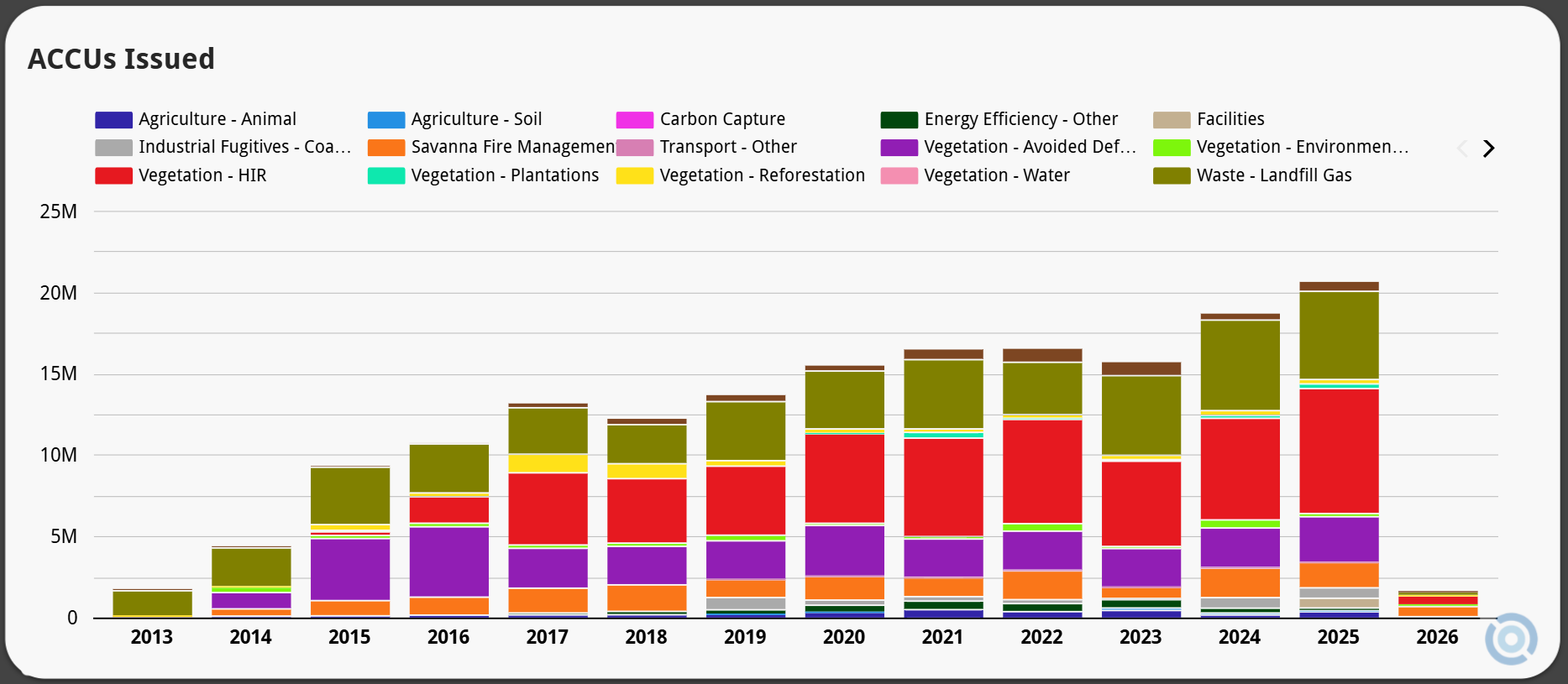

By contrast, savanna fire management (SFM) and HIR projects account for most of the ACCUs currently in the market. These methods have been operating for longer and generate credits at a larger scale, which explains their dominance in annual issuance.

ACCUs issued by method over time

Soil carbon and planting projects are often described as a ‘long tail’. Many are registered, but they take time to deliver measurable outcomes. Once these projects mature, however, they are expected to play a larger role. Because they offer long-term and auditable sequestration, they are also likely to attract higher prices as corporate buyers look for durable, high-integrity offsets.

Our Analytics Dashboard brings these trends together by showing both registration activity and issuance across different methods, helping users see the gap between current supply and the pipeline of future credits.

ACCUs issued comparing methods SFM to EP and Soil

Long-term investment and landscape resilience

Also in the Australian Financial Review, article CEFC’s Heechung Sung noted that environmental planting and sustainable agriculture projects take time to deliver. Outcomes are not immediate, but build steadily over decades. This is part of their value: they restore native species, support farming systems, and generate carbon credits with long-term integrity.

Because these projects mature slowly, tracking their progress is essential. Our Analytics Dashboard helps users see not only current registrations and issuances but also how different methods are evolving, highlighting projects with strong future potential.

High integrity credits drive market confidence

The combination of major corporate involvement and international investment signals confidence in the quality of ACCUs. High-integrity credits, backed by robust methodologies and auditable projects, are increasingly seen as essential for companies needing to meet emissions targets.

For professionals and corporates tracking the carbon market, this reinforces the value of having a clear, accessible view of project activities, methods, and regional distributions. Platforms that provide transparency, like our Project Explorer and Analytics Dashboard, make it easier to evaluate risk, opportunity and alignment with climate goals.

Australia’s carbon market is entering a phase where data driven insights and strategic investment go hand in hand. Meldora, with its scale, methodology and international backing, is an example for us to watch. For anyone involved in the carbon space, it’s critical to understand where projects are, how credits are generated and which methods are trustworthy.

References

Australian Financial Review, Lenaghan, Nick. Rio Tinto signs up for carbon credits from 250m agriculture platform. Published 5 September 2025.

Bloomberg: Rio Tinto to buy carbon credits from new Australian platform. Published 7 September 2025.

Want to know more?

Check out Dig it or plant it? Choosing the right carbon offset path, a closer look at pros and cons of tree planting versus soil carbon projects.

Want to know what potential your land has in the carbon market?

Download your free report: tailored for your property address

Access our carbon insights and tools at no cost

Analytics Dashboard: Get an aggregated view of ACCU projects, proponents and market insights.

Project Explorer: Uncover the geographic distribution of Australian ACCU Carbon projects