Indigenous land and corporate offsets: What is Qantas buying into?

Why big emitters are changing credit preferences

Demand from companies like Rio Tinto is reshaping which ACCU methods are seen as high integrity.

When Qantas announced that a quarter of its voluntary carbon offsets would come from Aboriginal and Torres Strait Islander projects, it wasn’t just a corporate promise. It was also a sign that indigenous land management is moving into the mainstream of Australia’s fight against climate change.

A key driver of this shift is Arnhem Land Fire Abatement (ALFA), an initiative created by Aboriginal landowners to support their engagement with the carbon credit market. ALFA uses traditional fire practices to cut greenhouse gas emissions, while funding cultural and ecological renewal across northern Australia.

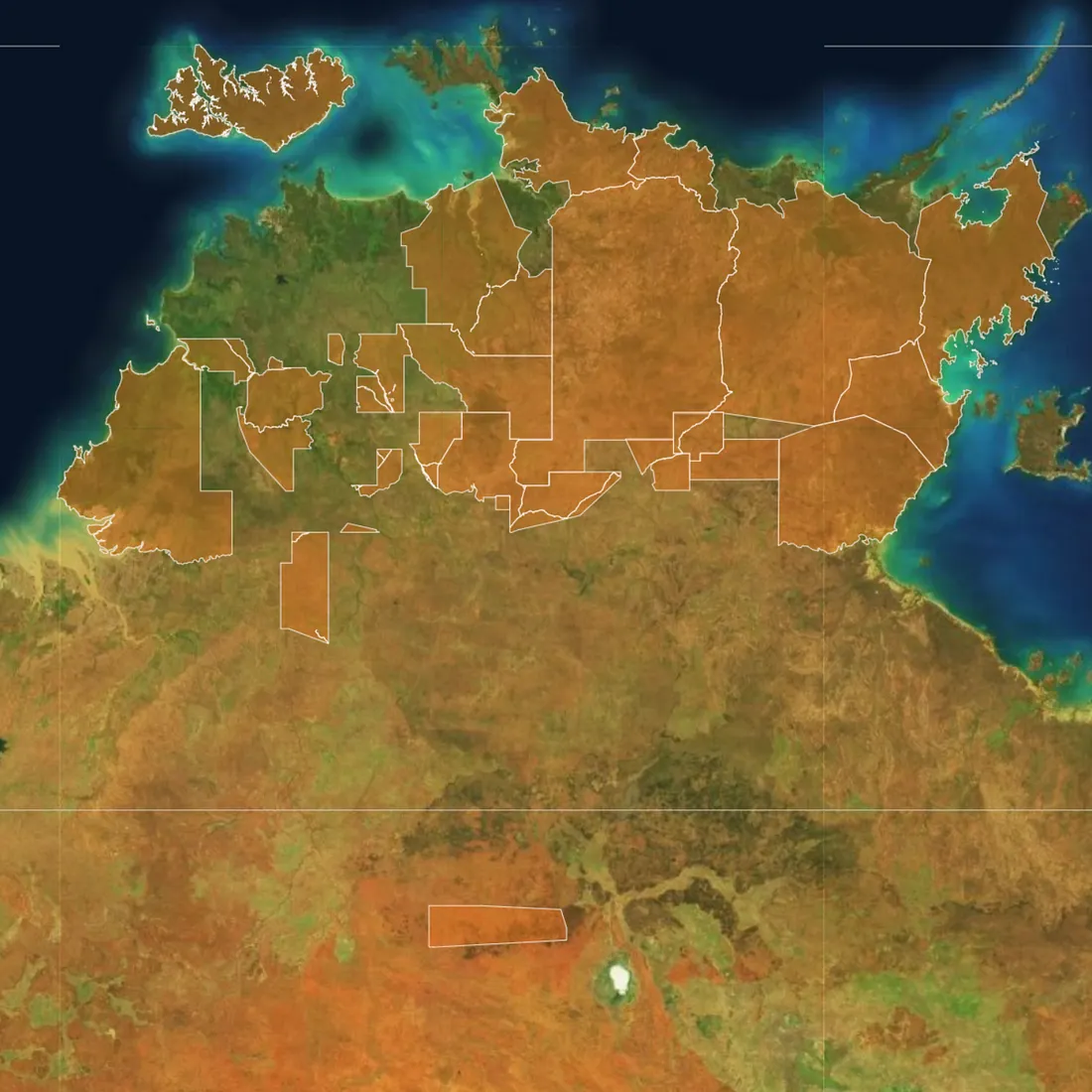

Arnhem Land and project boundaries

The Qantas commitment

Qantas has tied its reputation to a mix of efficiency gains, sustainable aviation fuel and carbon offsets. The airline’s pledge to source 25% of its offsets from indigenous projects matters for three reasons:

Revenue and jobs: It channels longer term funding into ranger groups, supporting community employment and training.

Market signal: It shows that indigenous land credits are in real demand, encouraging further investment.

Social impact: It reframes offsets as more than just tonnes of carbon, spotlighting who benefits from the abatement.

The airline’s partnership with Arnhem Land Fire Abatement has already delivered more than 64,000 tonnes of carbon abatement through traditional burning practices that also generate employment and positive cultural outcomes.

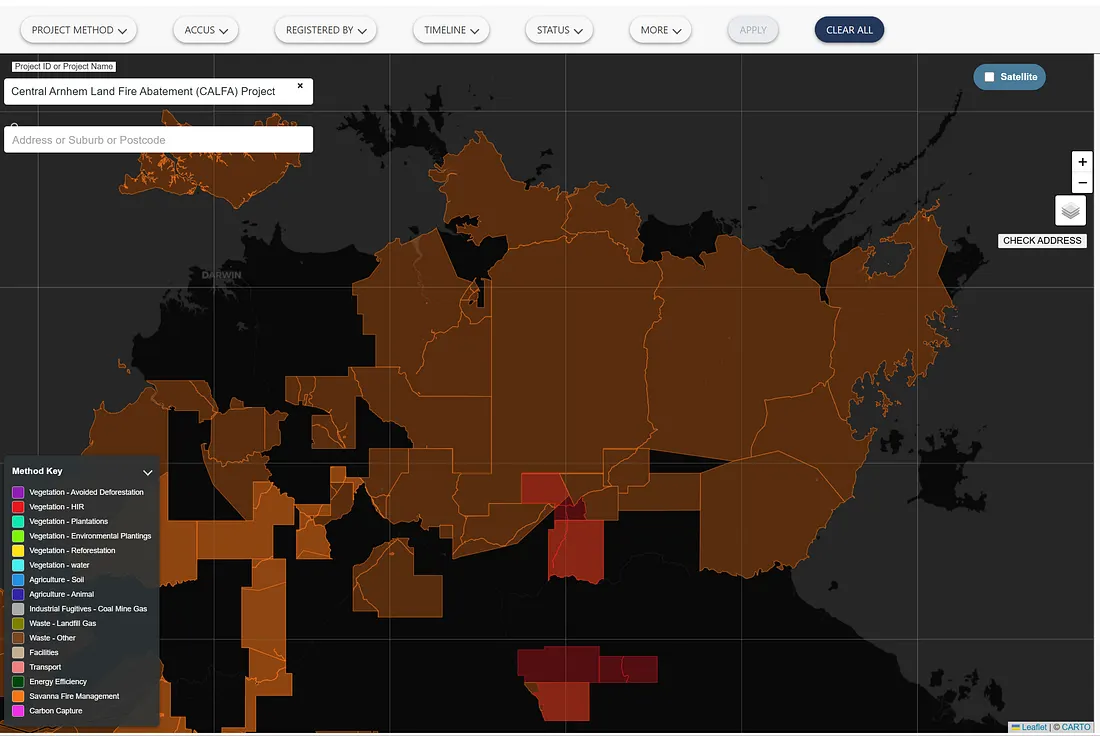

All Savanna Fire Management Projects in Australia

How ALFA Works

Arnhem Land is larger than many European countries. For decades, uncontrolled late-season fires destroyed habitat and released huge volumes of greenhouse gas emissions. It also undermined Aborginal ties to their traditional lands, or Country, a connection which is crucial to their culture and identity.

ALFA, a not-for-profit owned by Traditional Owners, flips this dynamic by reviving controlled early dry-season burns. These reduce the intensity of later fires and cut methane and nitrous oxide emissions. The result has been measurable carbon abatement, certified under Australia’s savanna fire management (SFM) methodology.

Beyond carbon, ALFA funds rock art protection, biodiversity monitoring and cultural transmission between generations.

If you’re interested in how new proposals could reshape savanna burning projects and the risks that come with changing credit rules, check out our blog article Carbon credibility: ACCU supply versus reputation

Mapping indigenous carbon projects

When you search for Arnhem Land in our project explorer, you can see exactly where the ALFA project sits within Australia’s broader carbon market.

The interactive map lets you:

Zoom and pan across the country to locate projects in context.

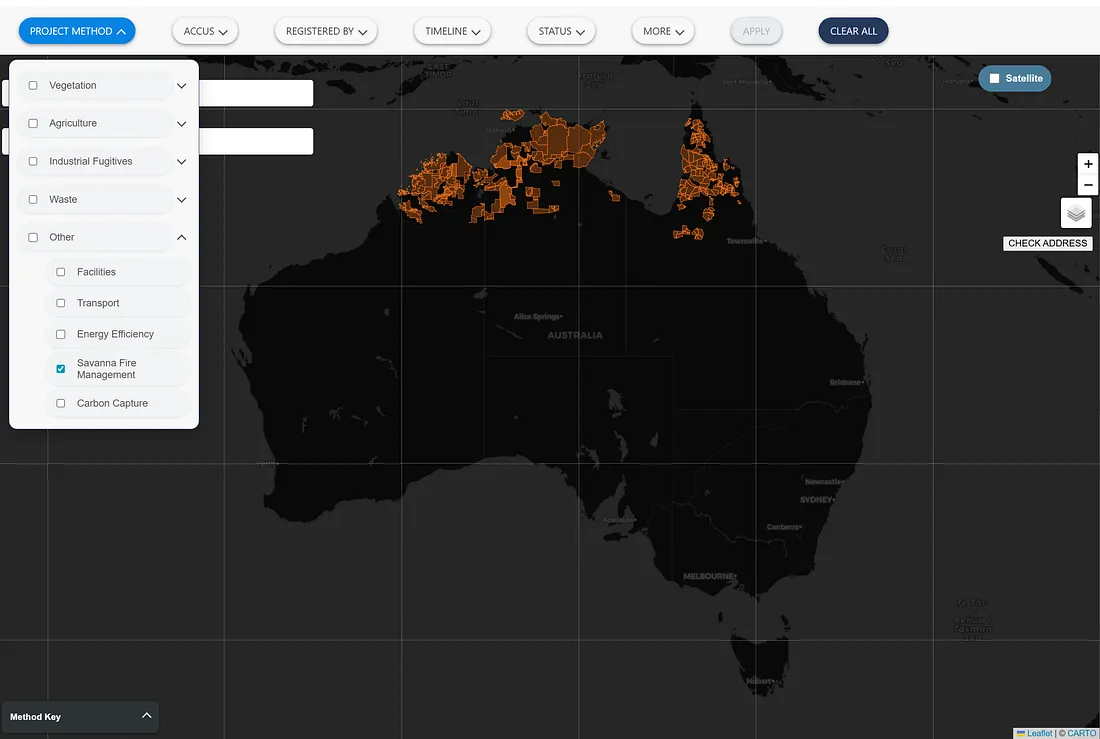

Different project methods across the country

Filter by method or status to highlight all savanna burning projects, or just those that are active and issuing credits.

Map filtered by ACCUs issued and Proponent ALFA (NT)

Drill into project details to see the method used, credits issued over time and the profile of the project lead or proponent.

ACCUs over time issued for West Arnhem Project

Toggle layers like satellite or street view to get different perspectives.

Satellite layer with project details - project is across 2 different locations

Looking at Arnhem this way shows how indigenous fire management sits alongside other project types across Australia. With a few clicks you can compare it to soil, vegetation or industrial schemes, or look for other proponent-led initiatives shaping the carbon market.

Why corporates care

From Qantas’ perspective, ALFA credits are more than offsets. They’re a chance to show leadership in reconciliation, procurement and climate. Investors are also paying attention, as credits that deliver co-benefits are more likely to hold their value in the face of increased scrutiny.

This raises a bigger point. As the market matures, not all credits will be equal. Those tied to transparent, community-driven outcomes are likely to stand out.

The bigger picture

Australia’s carbon market is full of tension right now, between supply and demand, between integrity and scale, and between old industrial projects and more recent land-based solutions. The Qantas-ALFA story highlights two key shifts:

Social licence: Companies need offsets that resonate with communities, not just accountants.

Geographic spread: Northern Territory, once seen as peripheral, is becoming central to national climate strategy.

Where this is leading

If more corporates follow Qantas’ lead, indigenous-led projects could see stronger, more stable demand. That would mean greater investment in ranger programmes, stronger cultural outcomes and a more resilient carbon credit supply.

However, it also depends on transparency. Tools like the project explorer are important so buyers, policymakers and communities can see not just where credits come from, but how projects interact with the surrounding land.

Final word

Qantas is seriously integrating indigenous projects into its carbon offset strategy. The Arnhem Land Fire Abatement project is at the heart of this move, already delivering more than 64,000 tonnes of carbon abatement through indigenous fire management.

This isn’t greenwashing. It delivers real climate outcomes while strengthening culture, creating jobs and funding community priorities.

Qantas’ partnership with ALFA isn’t the end of the story. It’s an example of how carbon markets can support both climate and the community. If this becomes the norm rather than the exception, Australia’s carbon credit market may finally earn the integrity and trust it needs to grow.

References

National Indigenous Times. Qantas commits to higher employment targets, $45 million Indigenous procurement spend and First Nations carbon offsets. Published 24 July 2025.

Arnhem Land Fire Abatement (ALFA) NT Ltd. Project information. https://www.alfant.com.au/

Clean Energy Regulator. Savanna Fire Management Methodology. https://www.cleanenergyregulator.gov.au

Qantas’s 2025–2028 RAP can be viewed here: https://www.qantas.com/au/en/qantas-group/sustainability/reconciliation-at-qantas.html

Want to know more?

Check out Carbon credibility: ACCU supply versus reputation, which looks at a new proposal from the CER which would mean existing projects could receive more credits for no additional action.

Want to know what potential your land has in the carbon market?

Download your free report: tailored for your property address

Access our carbon insights and tools at no cost

Analytics Dashboard: Get an aggregated view of ACCU projects, proponents and market insights.

Project Explorer: Uncover the geographic distribution of Australian ACCU Carbon projects