Who is paying for carbon projects in Australia

A closer look at fund–backed ACCU activity and what it means for investors

There are now close to 2,500 active ACCU carbon projects registered in Australia. Roughly 30% of those projects have been issued credits to date. The rest are still in development or early operational phases.

Photo by Dan Meyers on Unsplash

The historical context

For a long time, the funding story behind these projects was fairly simple. Projects were either run directly by emitters to meet internal needs or developed privately by landholders and carbon companies, often with bilateral offtake deals.

The arrival of capital markets

That has changed. Over the past few years, capital markets have moved in. Dedicated carbon and natural capital funds are now a material part of who is paying for projects, underwriting land acquisition, planting programmes and long-dated development risk. Public disclosures suggest more than A$1 billion of capital is either deployed or targeted across a relatively small number of platforms.

Why it matters for the market

This matters for investors and market analysts because fund backed projects behave differently. They tend to be larger, more standardised, more concentrated in specific methods and more sensitive to policy and price signals over extended timelines.

Categorising the landscape

To help make sense of this changing landscape, we have grouped the active funds into three distinct categories based on their investment philosophy:

➡️ Integrated Land Managers

➡️ Strategic Corporate Platforms

➡️ Dedicated Developer Funds.

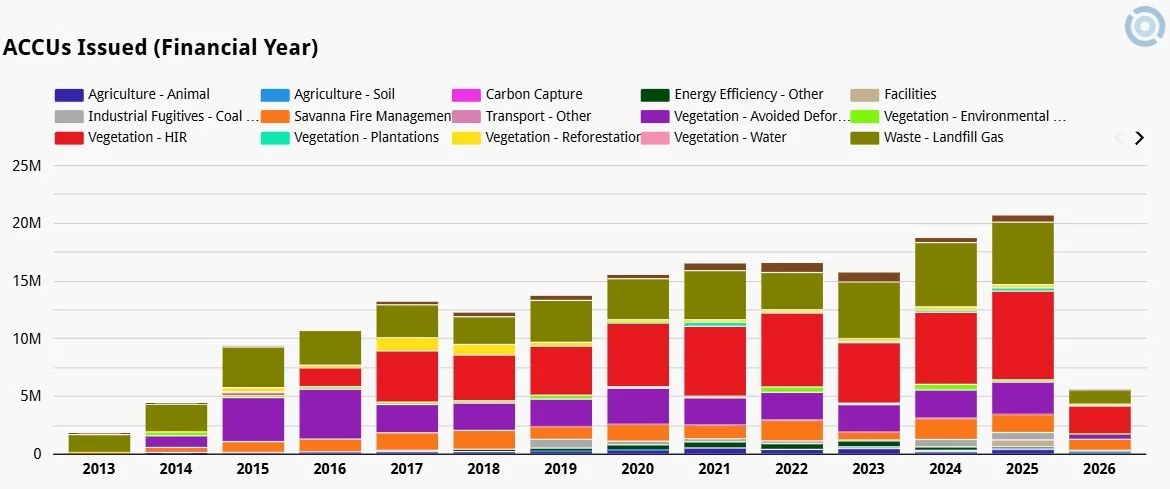

Find ACCUs Issued by Financial Year and more on the Analytics Dashboard

Integrated Land Managers

“These funds view carbon as a component of a broader natural capital strategy. They typically acquire productive farmland and integrate carbon projects alongside agriculture or timber operations.”

Meldora

Size: Approximately A$250 million platform

Parties: Managed by Gunn Agri Partners. Backed by CDPQ (La Caisse with around A$200 million) and the CEFC (with around A$50 million). Rio Tinto is disclosed as a foundation offtake buyer.

ACCU methods: Environmental Plantings integrated with broadacre agriculture

Meldora is a clear example of a blended agriculture and carbon strategy. Environmental Plantings are used alongside ongoing farm operations rather than as a pure land use conversion play. For funds and analysts, this structure reduces reliance on a single revenue stream but increases operational complexity.

Cibus Carbon

Size: Reported target of approximately A$200 to A$300 million

Parties: Managed by Cibus Capital. Partners and offtake arrangements are not publicly disclosed.

ACCU methods: Planted carbon and forestry methods similar to Environmental Plantings

Cibus Carbon appears to be positioning around large-scale planted carbon opportunities, consistent with Cibus Capital’s broader focus on food and agri systems.

New Forests (ANZ Landscapes and Forestry Fund-ANZLAFF)

Size: Approximately A$600 million at final close

Parties: Managed by New Forests. Limited partners are a diversified institutional base: with institutional limited partners including Mitsui & Co. and Nomura. Timber clients are managed separately from carbon.

ACCU methods: Plantation forestry with ACCU optionality rather than an ACCU only strategy

ANZLAFF is not a pure carbon fund. ACCUs are an optional overlay on a commercial forestry strategy. This distinction matters when comparing expected credit volumes or exposure to ACCU price movements.

See case study below about ANZLAFF: Sydney based $600m fund establishes new plantation in NSW southern highlands.

SLM Partners (SLM Agri Carbon Fund)

Size: Target of A$250 million

Parties: Managed by SLM Partners, a global natural capital manager. The fund targets high-rainfall grazing land.

ACCU methods: Soil Carbon and Environmental Plantings integrated with regenerative grazing

SLM Partners is a veteran in the natural capital space. Their strategy differs from pure carbon plays by maintaining active livestock production. For investors, this creates a diversified yield profile where ACCUs provide an 'alpha' kicker on top of agricultural operating returns.

Kilter Rural (Australian Farmlands Fund)

Size: Open-ended structure, historically managing over A$200 million in assets

Parties: Managed by Kilter Rural. Investments are backed by institutional capital and sophisticated investors.

ACCU methods: Soil Carbon and Environmental Plantings alongside irrigation and cropping

Kilter Rural has been a pioneer in testing soil carbon methods in complex cropping systems. Their approach highlights the move towards ‘inset’ strategies, where carbon credits are generated within high-production agricultural landscapes rather than just on marginal grazing land.

Strategic Corporate Platforms

“These funds are often backed by major emitters. Their primary goal is often securing a long-term supply of high-integrity credits for decarbonisation targets, rather than purely strategic trading.”

Silva Carbon Origination Fund

Size: A$250 million target with approximately A$80 million secured at first close.

Parties: Managed by Silva Capital, a joint venture with Roc Partners and C6. Cornerstone investors include Rio Tinto, BHP and Qantas.

ACCU methods: Reforestation and Environmental Plantings.

The presence of large Australian emitters as cornerstone investors is definitely worth nothing. It shows demand-side alignment but also means the fund is closely linked to corporate decarbonisation strategies and internal carbon procurement logic.

Australian Integrated Carbon (AIC)

Size: Not disclosed, but significant corporate balance sheet backing.

Parties: Backed by Mitsubishi Corporation, which acquired a 40% stake in 2021. The platform operates as a developer with strong international trade ties.

ACCU methods: Human Assisted Regeneration (HIR).

While AIC is technically a developer, the large backing from a global trading house like Mitsubishi puts AIC in the strategic category. It represents international capital entering the Australian market to secure carbon inventory, separate from domestic institutional superannuation funds.

Dedicated Developer Funds

“These funds focus on the ‘build and generate’ model. They often take on higher development risk to create credit inventory for sale into the secondary market.”

GreenCollar (EP Fund)

Size: Target of approximately A$100 million

Parties: Managed by GreenCollar. Backed by Ontario Teachers’ Pension Plan (OTPP) which holds a majority stake. Corporate buyers are targeted but not publicly named.

ACCU methods: Environmental Plantings using a developer and landholder model.

This fund sits closer to a traditional project development model. Land is typically retained by landholders while GreenCollar manages development and credit generation. The fund exposure is therefore more weighted to project performance and issuance rather than land value.

Kakariki Land Generation Fund

Size: Approximately A$100 million indicative, not fully disclosed

Parties: Managed by Kakariki Capital. Structure involves a developer undertaking plantings while the fund retains the majority of credits.

ACCU methods: Premium native Environmental Plantings on acquired agricultural land.

This model leans more heavily into land acquisition and long-term control of credit flows. From an investor perspective, it concentrates both land price risk and method risk in a single vehicle.

Climate Friendly (Adamantem Capital)

Size: Private Equity backed corporate structure

Parties: Majority owned by Australian Private Equity firm Adamantem Capital since 2021.

ACCU methods: Diverse portfolio including HIR, Soil Carbon and Environmental Plantings.

The acquisition of Climate Friendly by Adamantem marked the entry of traditional private equity into the sector. Unlike the property-backed funds in the first category (Integrated Land Managers), this represents an investment in the operating platform and project pipeline itself.

Sydney based $600m fund establishes new plantation in NSW southern highlands

Sydney based $600m fund establishes new plantation in NSW southern highlands.

The Big Hill Carbon Project has recently been registered under the plantation methodology - Schedule 3 - which was introduced to reverse the trend of plantations being converted to pasture. Plantations sequester several times more CO₂ per hectare than typical improved pasture.

The 1800ha property was purchased in July for over $20m for the New Forests ANZLAFF Fund. The fund manager is jointly owned by Japanese corporates Mitsui & Co., Ltd. and Nomura. The fund has received over $5m for establishing new plantations in NSW from Support Plantation Establishment program: a grant set up the Department of Agriculture, Fisheries and Forestry.

The property is located near existing planation infrastructure (Belanglo, Penrose).

New Forests have also recently registered an Environmental Planting project of 1600ha near Abercrombie National Park as well as purchasing a large share in the 8000ha McPhee Beef Farms in Walcha NSW.

View recently registered Big Hill Carbon Project (ERF206012) on Project Explorer

Over the past decade Tasmania has lost 10 percent of its commercial plantation area. Most of the 40,000 hectares lost was converted to grazing land after harvest. Read about how a new ACCU method is keeping carbon in the ground and forests in production:

Tasmania’s forests: ACCU method creates carbon-smart land investment opportunities

What this tells us about the market

A few patterns are clear.

First, Environmental Plantings are the method of choice for institutional capital. Almost every fund listed above relies a lot on planted vegetation methods. This reflects current investor comfort with permanence, monitoring and scalability, but it also creates concentration risk at the method level.

Second, capital is being deployed ahead of issuance. With only around 30% of projects issued across the market, much of this funding is underwriting long development periods with regulatory and delivery risk still in play.

Third, strategic money is moving upstream. The involvement of heavyweights like Rio Tinto, BHP, Qantas and Mitsubishi suggests that large buyers are no longer waiting for credits to appear on the spot market. They are funding the projects to ensure future supply.

Finally, this is still a small club; despite the size of individual funds, the number of active platforms above A$100 million remains limited, although at least one other fund of this size has launched privately, and there may be others.

Why independent project data matters

As more money flows into carbon projects, it gets harder to tell the difference between a good story and what’s actually happening in reality. Things like land quality, rainfall, past land use, method eligibility and how a project has really performed all matter. They influence the outcomes in ways that don’t magically smooth out once projects are bundled into a fund.

Tools that aggregate and normalise ACCU project data across methods and regions are becoming essential for investor due diligence, portfolio construction and secondary market analysis.

Note: The analysis and capital deployment figures presented here are correct at the time of writing. However, the carbon market landscape is rapidly evolving; fund mandates, capital flows, and project data are subject to change as new public disclosures are made.

References

Clean Energy Regulator (CER):

Public fund announcements and investor disclosures

Carbon Eyes ACCU project register and project level analytics

Carbon Eyes market commentary on ACCU project activity and issuance trends

Hero Image

Photo by Dan Meyers on Unsplash

Want to know more?

The Glenclair Aggregation covers roughly 4,000 ha in the New England region of NSW and shows the potential for carbon farming and long-term environmental restoration. Read about it here: New environmental planting project to boost ACCU supply.

Carbon Eyes | ACCU Market Intelligence

Strategic data and integrity signals for the Australian carbon market.

1. Carbon Data Platform

The Foundation of Market Transparency | Access the Platform

A comprehensive view of the ACCU landscape. Access structured CER data, project status and issuance trends. Use our core mapping and analytics to establish your market baseline.

2. Integrity & Market Intelligence

Independent Ratings & Supply Forecasts | Upgrade Your Intelligence

Mitigate risk with our paid intelligence layer. Accessed directly within the Platform, these add-ons provide independent ACCU project ratings and forward looking supply forecasts to guide procurement and investment.

3. Land & Asset Decisioning

Identify the Best Opportunities for Carbon Projects

Carbon Potential Report | View Carbon Potential Report (by address)

Instant, address-based viability assessments for lenders and investors.

Carbon Land Search | Identify & Assess High-Potential Assets

Our premium search engine for institutional funds. Identify and de-risk high-potential carbon assets before acquisition.