Tasmania’s forests are making a comeback: ACCU method creates carbon-smart land investment opportunities

How a new ACCU method is keeping carbon in the ground and forests in production

Over the past decade Tasmania has lost 10 percent of its commercial plantation area. Most of the 40,000 hectares lost was converted to grazing land after harvest. But that is starting to change.

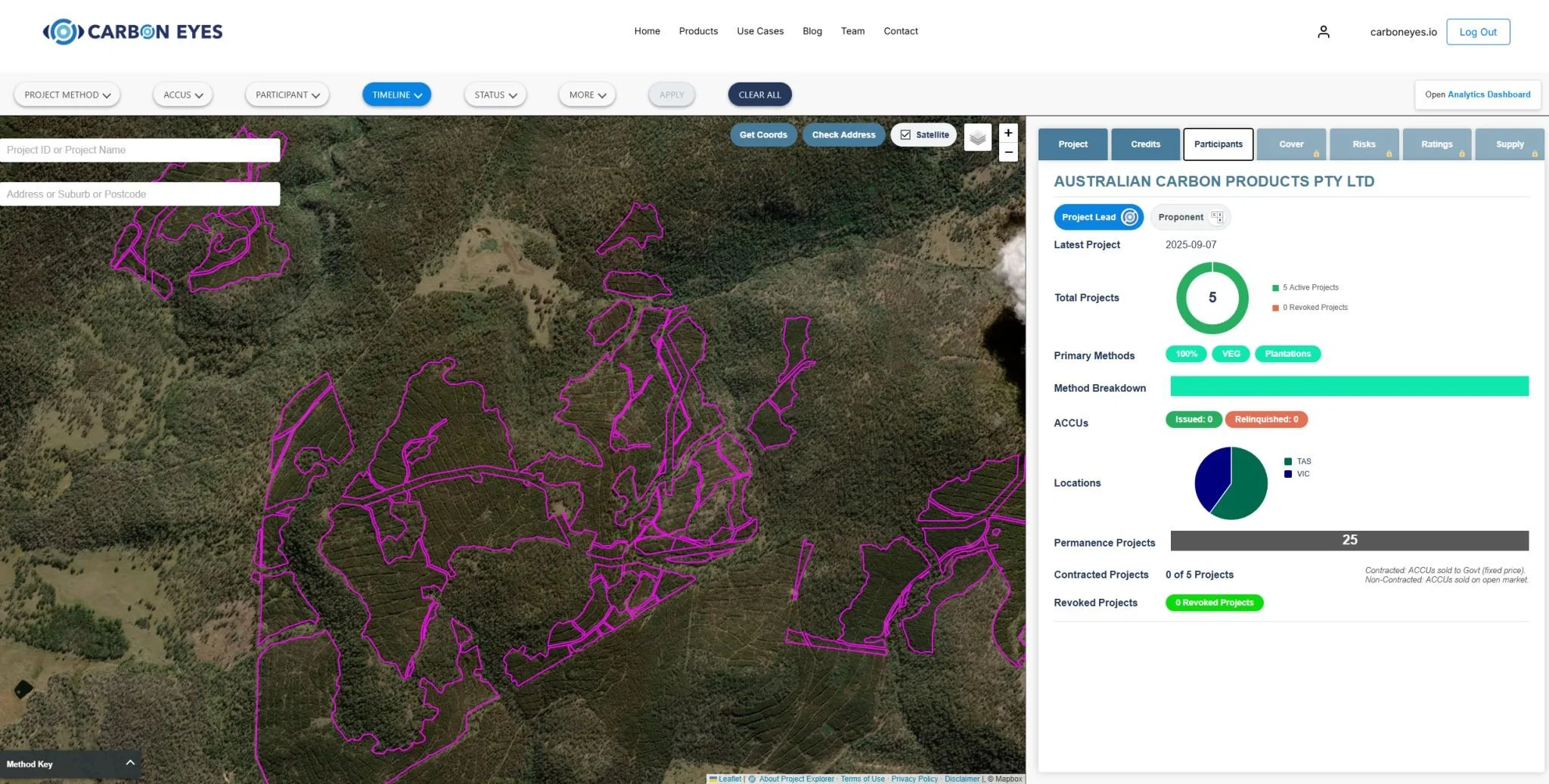

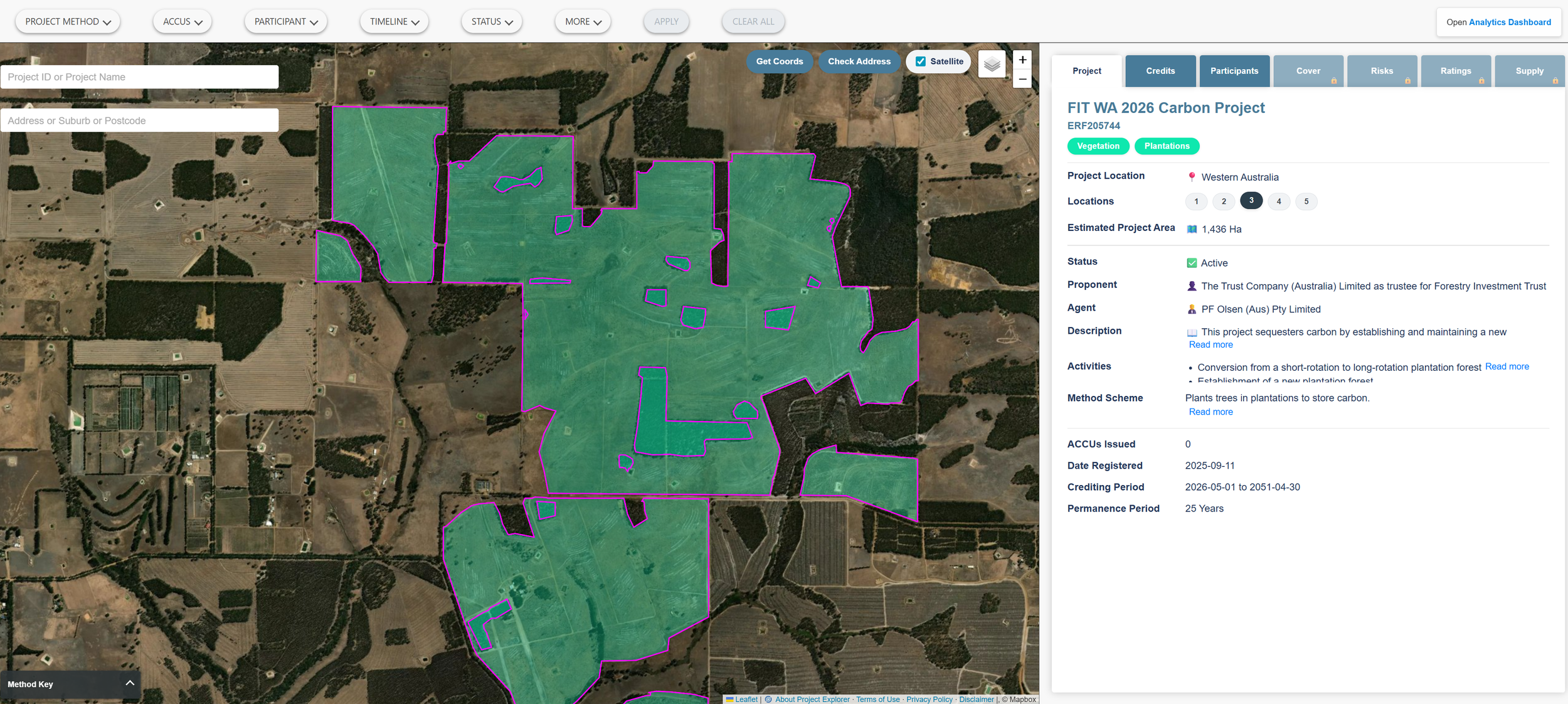

Explore this project and more: Tasmanian forestry project link

Stopping forest loss with new methodology

In 2022, an ACCU carbon methodology was added to address this loss of carbon storage capacity by rewarding landholders for keeping plantations in rotation instead of clearing them. Under this Schedule 3 approach, forests stay in production and carbon stays in the ground.

Since the method was introduced, no new conversions to grazing land have been recorded.

Why this matters for carbon and land investors

The introduction of Schedule 3 shows how targeted carbon policy can influence land use decisions. Forests have long been recognised as a significant carbon store, but when plantations are cleared for grazing, that capacity is lost. The ACCU Schedule 3 method creates a financial incentive to maintain forests in rotation.

For investor funds looking at land with carbon potential, this is an important sign. Areas previously under pressure for grazing are now being stabilised under verified carbon projects. The market for carbon credits tied to sustainable forestry in Tasmania is growing, and the early uptake is promising.

8 new projects were registered using this method in September, showing that both investor interest, changes to land use and regulatory confidence. These projects were registered by notable participants including Timberlands Pacific Pty Ltd, SFM and PF Olsen Australia, with oversight from the CER (Clean Energy Regulator).

How it works

Landholders who keep forests in production rather than converting to grazing can claim ACCUs. The method does not prevent harvesting, it keeps forests within a productive rotation while ensuring carbon remains stored in the ground.

This contrasts with other approaches that might reward reforestation after clearing, which only addresses emissions retrospectively. By focusing on retention, this method prevents further carbon loss while supporting ongoing forestry operations.

For investors, this creates projects that are both environmentally and commercially viable. Timber can still be harvested sustainably, and carbon credits are generated at the same time. The dual benefit makes the projects attractive for funds looking at land that delivers both revenue streams and ESG impact.

Early results and what they tell us

Since the Plantation forestry method was introduced, no new conversions to grazing land have been recorded in Tasmania. This suggests the financial incentive is working and with so many new projects registered this shows growing confidence and uptake. These projects represent a mix of commercial forestry operators and experienced project developers. This suggests the methodology is being adopted by entities who can scale.

It also demonstrates that carbon policy can influence behaviour without forcing it. By tying financial incentives to outcomes, the scheme aligns environmental and commercial goals, a model that other regions and sectors could learn from.

Explore this project and more: Tasmanian forestry project link

What it means for the market

The early success of of this methodology indicates a few key points for investors and stakeholders:

Retention-based carbon methods can create predictable, long-term carbon storage without disrupting commercial activity.

Tasmania’s forestry projects are emerging as a credible source of ACCUs, with clear oversight from the CER (Clean Energy Regulator).

For funds looking at land investment, forestry with integrated carbon projects offers both revenue from timber and carbon credits, enhancing the financial case.

Well-designed carbon methodologies like this can protect forests, generate credits and provide landholders and investors with a measurable impact. They demonstrate that carbon markets can work alongside commercial operations rather than against them.

Tasmania’s forests are not just coming back, they are demonstrating a pathway for carbon-smart land investment.

References

CER (Clean Energy Regulator):

About the method: Plantation forestry method

The method determination: Carbon Credits (Carbon Farming Initiative-Plantation Forestry) Methodology Determination 2022

Want to know more?

Read about why carbon projects aren’t replacing farming but changing it: Beyond farm vs carbon trade-off: New chapter for Australian land use

Want to know what potential your land has in the carbon market?

Download your free report: tailored for your property address

Access our carbon insights and tools at no cost

Analytics Dashboard: Get an aggregated view of ACCU projects, proponents and market insights.

Project Explorer: Uncover the geographic distribution of Australian ACCU Carbon projects