ACCU methods unpacked: What’s driving real value?

Exploring performance across key ACCU methods

Generic price signals hide what’s really happening. Method-level data shows where confidence and demand are building.

Australian Carbon Credit Unit (ACCU) price signals can be misleading, but a deeper look into specific project methodologies shows where market activity and confidence are building. This blog post looks at performance, market dynamics, and future outlook for three key carbon credit methods.

Environmental planting is quietly gaining traction

This is one method where the story is more positive. There’s not much noise around enviromental planting but it’s gaining respect. When these credits move, they tend to go for a premium. They are attracting more buyers who want quality and credibility, rather than just credits that are easy to find and cheap.

Voluntary buyers are increasingly drawn to this method, while Safeguard Mechanism buyers remain more focused on cost and often choose the cheapest available options.

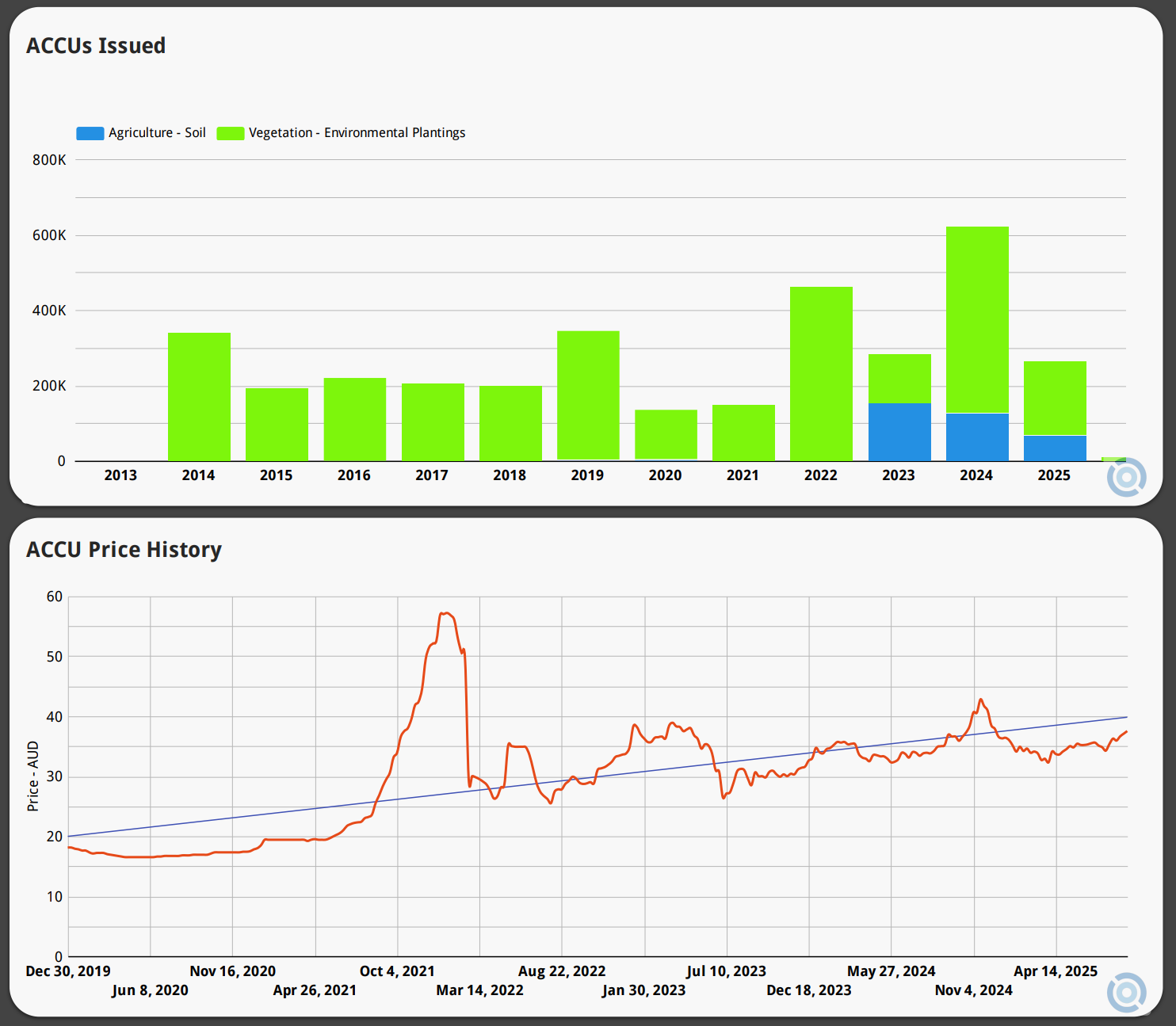

The trading volume for EP still remains low, but unlike human-induced regeneration (HIR), the flat lines here are more likely to point to three things: firstly, a lack of supply, rather than a lack of interest; secondly, an indicator that credits are being sold off-market; and thirdly, that some emitters are also project proponents, and are offsetting directly. The market looks like it has confidence in this method, even if the volumes don’t show this yet.

Many EP projects were registered years ago, but are yet to be established or begin abating. Those that have started and are actively delivering credits tend to do so steadily over time.

If you’re thinking long term, environmental planting is where the market wants to be. It has a convincing story, it has integrity, and over time it’s expected to command a higher price. This method is set to be a premium option in the market. It is tangible, visible, and easily validated.

The volume of credits claimed under EP projects has been patchy over the last few years. This is difficult to explain as one would expect to see a steady increase in the credits as more project go live and existing projects enter there higher yield phases, typically years four to seven.

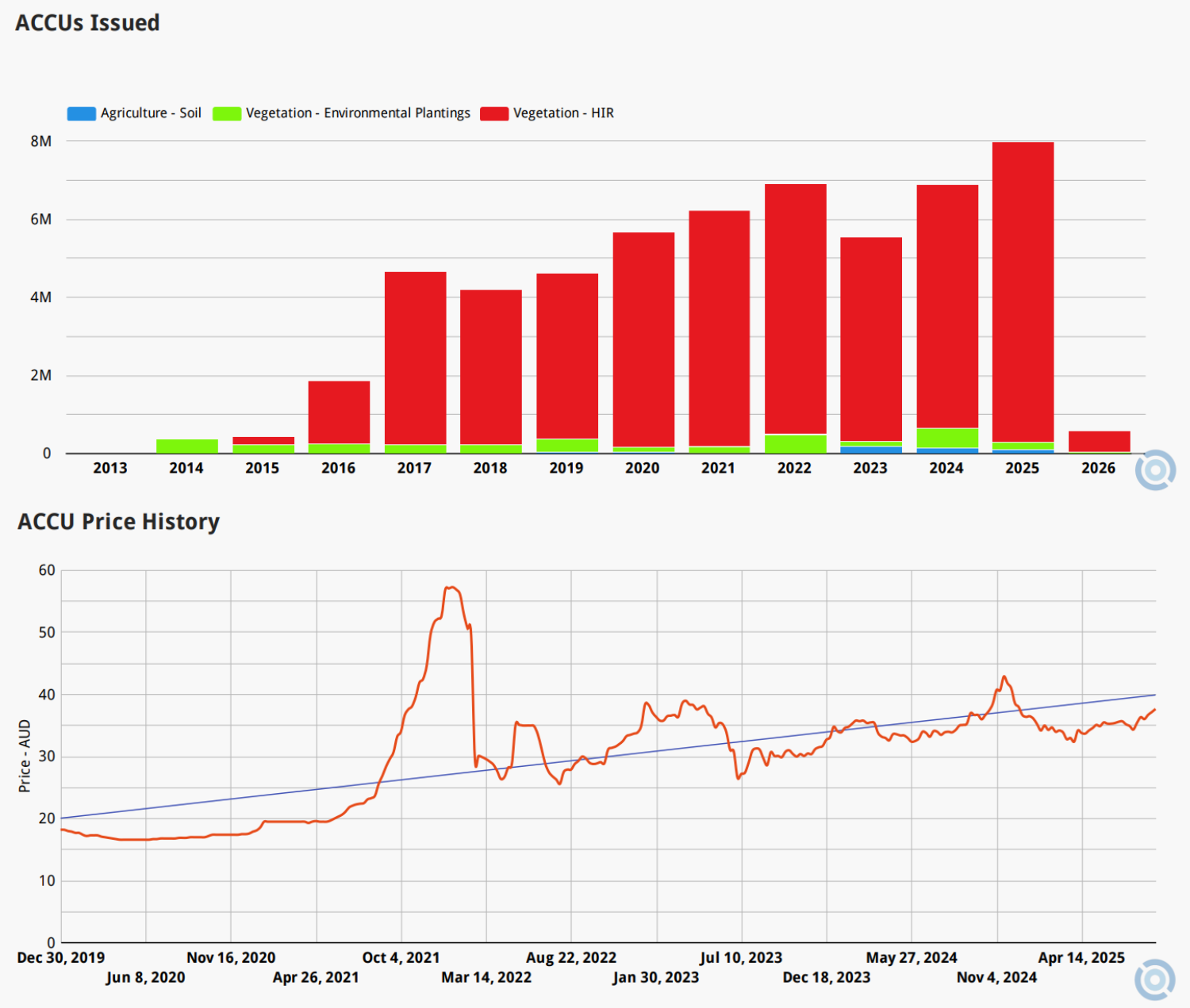

Looking at the historic ACCU price chart below provides partial answers. It’s likely the spike in credits claimed in 2022 (financial year) was in response to the rapidly rising price in late 2021. Remember credits are not “awarded”, they are claimed, when the project proponent decides to do so. After the rapid drop of prices in early 2022, proponents may have been waiting for a recovery before claiming credits. This led to the low 2023 levels and another spike in credits claimed in 2024 as prices slowly recovered.

If we look at 2025, we see trading volumes for EP projects are low and patchy. Prices for quality methods are not getting much momentum. The supply is coming slowly, but the market has not caught up yet, or perhaps, it is still waiting for clearer demand signals, especially from the voluntary side.

Soil carbon is better but still a bit fragile

This is another method worth watching. The market clearly likes the potential of soil carbon, with prices holding up. And there’s a growing wave of forward interest, but the trust is not fully there yet.

The problem is the legacy of inconsistent science and mixed results, often highlighted by critics and experts in the field. Buyers want to believe in the potential for storing carbon in soil, but they also want solid evidence. That means even when prices are steady, they are often supported by very small volumes. At present, there is not enough buying and selling to build a dynamic market on.

Recent method updates and growing data from trials in New South Wales and Victoria will help, but we are still in a kind of limbo. Buyers are circling, while sellers are still hesitant. Industry participants and buyers are closely watching the next big trial results or methodology tweaks.

The market is eager for quality credits, and soil carbon could satisfy some of that demand. As a method it is moving in the right direction, and is now priced as realistic option, not just a theory.

Why soil credits are taking time

If you’ve been watching the charts and wondering why soil carbon still isn’t showing up in ACCU issuance stats, you’re not alone. The reason is simple: there’s a lag.

Registering a project is just the start. Credits don’t flow until well after the first reporting period, which can take one to two years, or even longer for complex methods like soil carbon. Time is needed to get baseline data, establish practices, measure abatement, then go through a full audit.

Project Registrations by Method: Graph shows carbon project registrations in Australia by method and year.

That’s exactly what’s happening with soil. Registrations surged from 2021 to 2023 as interest spiked, but most of those projects are still maturing. It’s a pipeline story, which means there is likely to be a wave of soil credits hitting the market over the next couple of years.

Environmental plantings are a different beast. Most EP projects were registered years ago and now deliver credits consistently. They’re long-lived, steady and trusted, even if new registrations have slowed.

So while soil looks quiet on the surface, don’t mistake that for a lack of potential. It’s just a matter of time before a growing number of projects start earning credits.

Plenty of human-induced regeneration registered but not much trading

HIR is a strange one. It’s well known but is looking more like a method in slow decline. There seem to be two types of HIR credits floating around, some tied to older projects with quirks, and other newer ones, which are not quite aligned with buyer expectations.

One important point is that new projects cannot currently register under HIR, which limits its growth potential. Despite a steady flow of ACCUs claimed each year, this is not represented in the trading prices.

HIRs accounted for 11% of June’s total market trading activity, up from a quiet May, but what’s clear is that the market isn’t that interested. While prices haven’t crashed, they haven’t gone up either. The flat lines on the charts mostly represent a lack of recent trades, which has led to a growing price spread between HIR and EP credits.

Human-induced regeneration isn’t broken, but it’s not exciting either. It lacks the high-integrity story of environmental planting and the innovation buzz of soil. It’s just there, in the background.

Unless there’s a serious shift in how HIR projects are developed or verified, this method will probably continue to lose relevance over time.

Key takeaways: Quality, potential and decline

A deeper look at individual ACCU methods shows us a market with much more going on than suggested by generic pricing.

Environmental Planting is a quietly respected method, gaining traction among quality-focused buyers, despite low trading volumes, suggesting supply hasn’t kept up with demand, rather than disinterest.

Soil Carbon shows significant potential, but remains fragile due to scientific inconsistencies in the past and the time lag between project registration and ACCU credits being issued.

HIR appears to be in decline, facing limited market interest and no new project registrations.

Understanding these method specific trends is important for grasping the true landscape of Australia’s carbon market.

References

CER ERF Project Register

https://www.cleanenergyregulator.gov.au/ERF/project-and-contracts-registers/project-registerCER Quarterly Market Report

https://cer.gov.au/markets/reports-and-data/quarterly-carbon-market-reportsJune 2025 Report

CORE Markets. (2025, July 3). ACCU Market Monthly Report — June 2025. Retrieved from https://coremarkets.co/insights/accu-market-monthly-report-june-2025May 2025 Report

CORE Markets. (2025, June 5). ACCU Market Monthly Report — May 2025. Retrieved from https://coremarkets.co/insights/accu-market-monthly-report-may-2025April 2025 Report

CORE Markets. (2025, May 7). ACCU Market Monthly Report — April 2025. Retrieved from https://coremarkets.co/insights/accu-market-monthly-report-april-2025

Want to know more?

If you haven’t already, check out ACCU Price Signals: What Flat Lines Are Really Telling Us, which takes a look beyond the charts to understand where the real market activity is happening.

Want to know what potential your land has in the carbon market?

Download your free report: tailored for your property address

Access our carbon insights and tools at no cost

Analytics Dashboard: Get an aggregated view of ACCU projects, proponents and market insights.

Project Explorer: Uncover the geographic distribution of Australian ACCU Carbon projects