Coming soon: Taronga Zoo and Sydney Airport Carbon Project

What this project says about scale and limits

Large landscape projects highlight both the potential and constraints of ACCU supply.

Taronga Zoo Conservation Society Australia, Sydney Airport and the NSW Government have teamed up to restore a Box-Gum Woodland on a cleared farming aggregation totaling 3050 ha.

Credit: Taronga Conservation Society Australia

✔️ Taronga Zoo Conservation Society aims to restore two million hectares of threatened woodlands across eastern Australia.

✔️ Once planted, Sydney Airport will use the resulting ACCUs to help it reach its 2030 net zero target.

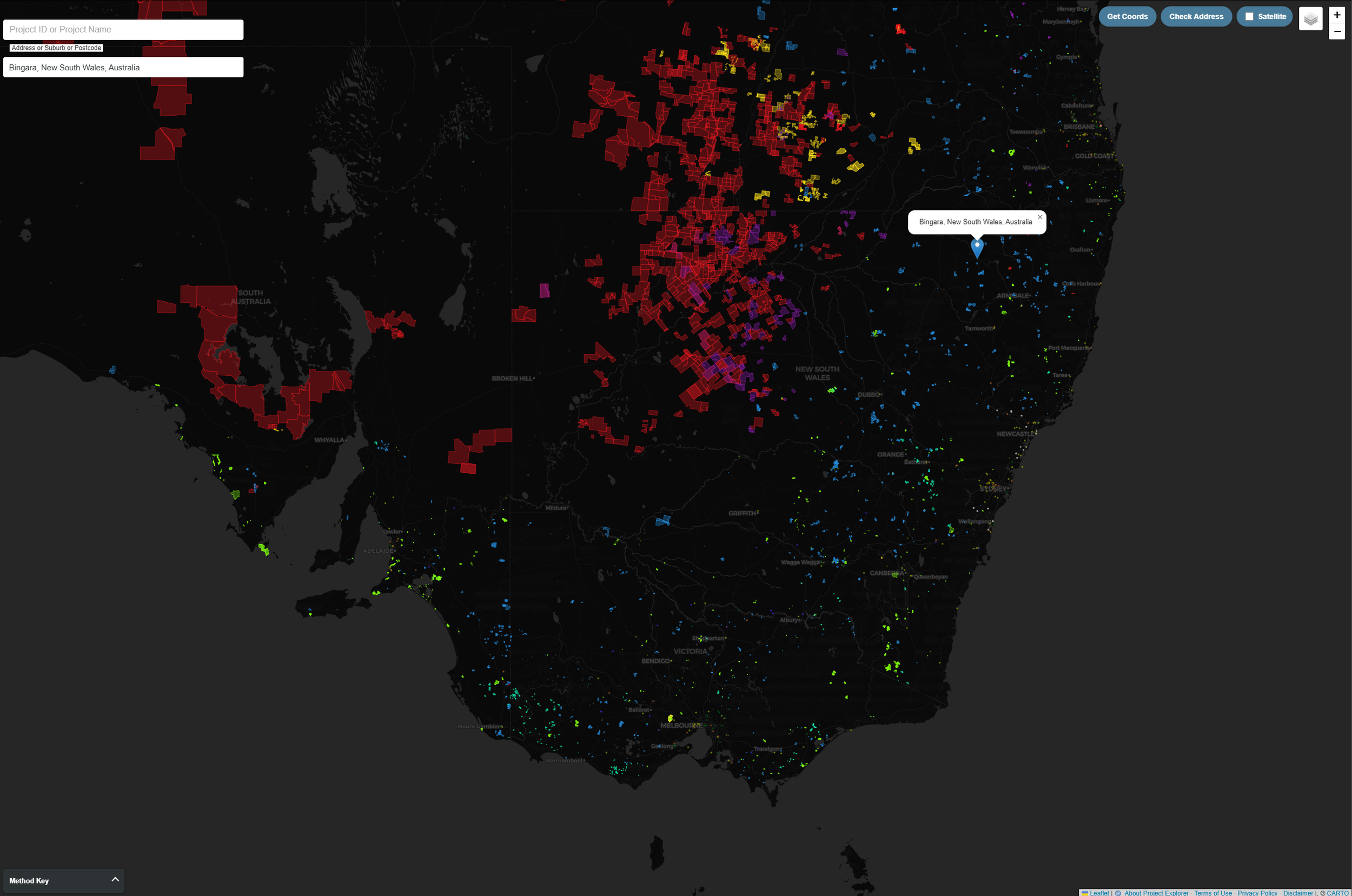

✔️ The farm aggregation is located south west of Bingara: inland from Coffs Harbour and north of Tamworth in NSW. There are numerous soil carbon projects on surrounding farms in this area.

There are numerous soil carbon projects (blue) on surrounding farms via Project Explorer

What is actually happening on the ground

The Bingara project centres on restoring a large cleared farming aggregation totalling 3050 ha back to native Box Gum Woodland, one of the most heavily cleared and threatened ecological communities in eastern Australia.

According to public reporting, the site has been selected specifically for its size, ecological value and ability to support long term restoration rather than short rotation carbon outcomes. This isn’t just a small plot or a single property; it’s a coordinated, landscape scale restoration effort.

The project combines large scale tree planting with long term habitat restoration, with biodiversity co-benefits alongside carbon generation from the start. Reintroduction native species, habitat connectivity and long term land stewardship are at the heart of the project design, not secondary biodiversity outcomes added after the fact.

Sydney Airport intends to use the ACCUs generated from this project. That direct link between land restoration and a specific corporate decarbonisation goal, significantly lowers the project’s risk compared with speculative carbon schemes.

Taronga aims to restore two million hectares of threatened woodlands across eastern Australia. Once planted, Sydney Airport will use the resulting ACCUs to help it reach its 2030 net zero target.

Why this project matters for investors

This project could be the same as Taronga’s Habitat Positive rewilding project announced in 2022, continuing the same landscape scale restoration work but now with a clearly defined corporate offset buyer from day one.

Like Habitat Positive, it is landscape scale, focused on threatened ecological communities, and designed around long term ecological restoration rather than short crediting cycles.

For investors, that distinction matters.

This model materially reduces demand risk. Sydney Airport is not purchasing opportunistic offsets on the secondary market. It is securing ACCU supply linked to a specific land use change, delivered over time, and aligned with a fixed 2030 net zero commitment.

That in turn raises the bar on land selection, project governance and delivery standards. Land needs to support long lived vegetation, measurable biodiversity outcomes and credible carbon generation under scrutiny.

This is not about maximising short term credit yield. It is about building durable natural capital assets that remain relevant as integrity expectations tighten.

Previous Taronga project example

Taronga Zoo has a history delivering large, brand backed carbon projects with measurable outcomes.

Taronga Zoo’s first carbon offset project in 2015 partnered with Woolworths to fund the Urisino Ecosystem Regeneration Project in western NSW. Woolworths purchased ACCUs to offset emissions from the Super Animals collectables campaign, a nationwide educational initiative that reached hundreds of thousands of primary students and promoted awareness of Australian wildlife.

The funding supported extensive regeneration of over 800 square kilometres of degraded bushland, protecting habitat for species such as Brolgas, Major Mitchell Cockatoos, Bush Stone Curlews, Stimson’s Python and Black-breasted Buzzard, alongside other mammals and reptiles.

The project remains active and has generated over 750,000 ACCUs to date (project data). This example shows Taronga Zoo’s long track record of delivering large land based restoration projects with verified credits, corporate partners and real environmental outcomes.

Taronga’s long track record in delivering landscape scale carbon

projects with verified credits.

What this says about land acquisition criteria

Projects of this size only work on the right land, and that is becoming increasingly clear across the market. The Bingara aggregation reflects the filters now being applied by institutional investors and large corporate buyers:

➡️ aggregation scale rather than isolated parcels

➡️cleared or degraded land with genuine restoration upside

➡️ecological communities with recognised conservation value

➡️suitability for both carbon sequestration and biodiversity outcomes

➡️capacity for long term management and monitoring

➡️alignment with regional restoration corridors or government priorities

Land that meets these requirements exists, but it takes real work to find it. That is where data led platforms come in.

Land purchase advisory gives investors confidence and speeds decisions. It sits between land markets and carbon markets, helping investors filter for the narrow overlap between viable carbon potential, biodiversity outcomes and realistic land value. Not every large block works, and not every carbon estimate adds up once soils, rainfall, land use history, tenure and method eligibility are properly tested.

Good advisory and data tools help funds screen properties at scale, rule out unsuitable land early and focus capital on sites that can realistically support credible, long term carbon and ecological projects.

We talk about the ACCU scheme a lot in abstract terms. Millions of tonnes here, safeguard targets there. It is hard to get a feel for what any of it actually means in the real world, read more about it here: Could the entire ACCU scheme offset all Qantas Group emissions

Why this favours investor funds over individual landholders

This type of large project is capital intensive, slow to mature and operationally complicated.

Set up costs, long timelines, biodiversity monitoring, permanence obligations and credit governance all require long-term capital and professional teams who know how to actually deliver them. This makes it most suitable for investor backed funds that can aggregate land, diversify risk and contract directly with large offsetters (like Sydney Airport).

Individual landholders can still take part, but in the case of these larger projects, it would be more likely through aggregation, partnerships or fund led structures, rather than single standalone projects.

Australian carbon projects are moving away from small, one off sites and towards larger, aggregated land holdings built to meet scale, scrutiny and longer term project delivery.

References

Taronga Zoo Conservation Society, posted 10th Dec 2025:

Taronga Zoo Conversation Society, media release 20th Apr 2022

Photo Credit (Main Image)

Credit: Taronga Conservation Society Australia

ABC News article, posted 10th Dec 2025:

Carbon Eyes: Taronga Zoo project registered in 2015

Photo Credit: Koala in tree:

Attribution: Image by wirestock on Freepik

Want to know more?

Check out: University of Melbourne quietly retires 76,000 ACCUs, talking about how an Australian university is approaching high‑quality offset procurement

Carbon Eyes | ACCU Market Intelligence

Strategic data and integrity signals for the Australian carbon market.

1. Carbon Data Platform

The Foundation of Market Transparency | Access the Platform

A comprehensive view of the ACCU landscape. Access structured CER data, project status and issuance trends. Use our core mapping and analytics to establish your market baseline.

2. Integrity & Market Intelligence

Independent Ratings & Supply Forecasts | Upgrade Your Intelligence

Mitigate risk with our paid intelligence layer. Accessed directly within the Platform, these add-ons provide independent ACCU project ratings and forward looking supply forecasts to guide procurement and investment.

3. Land & Asset Decisioning

Identify the Best Opportunities for Carbon Projects

Carbon Potential Report | View Carbon Potential Report (by address)

Instant, address-based viability assessments for lenders and investors.

Carbon Land Search | Identify & Assess High-Potential Assets

Our premium search engine for institutional funds. Identify and de-risk high-potential carbon assets before acquisition.